Services

Our Dynamic Share Market Learning Services

Equip yourself with the knowledge to confidently navigate the markets, decode trends, and optimize your portfolio.

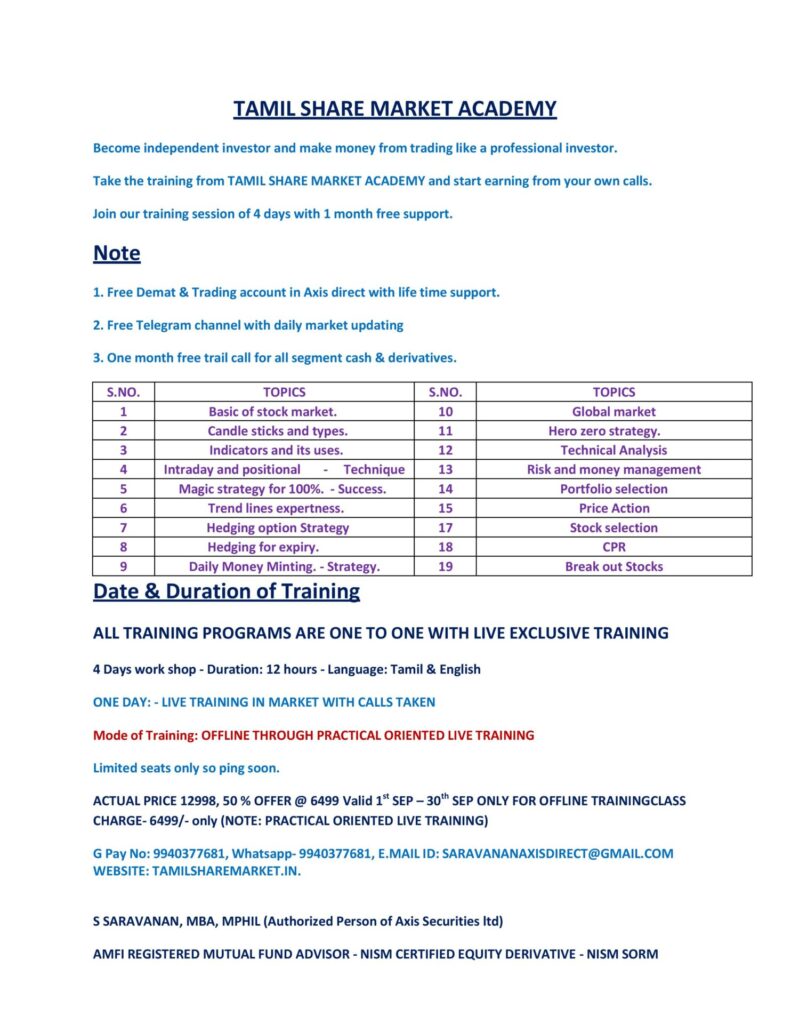

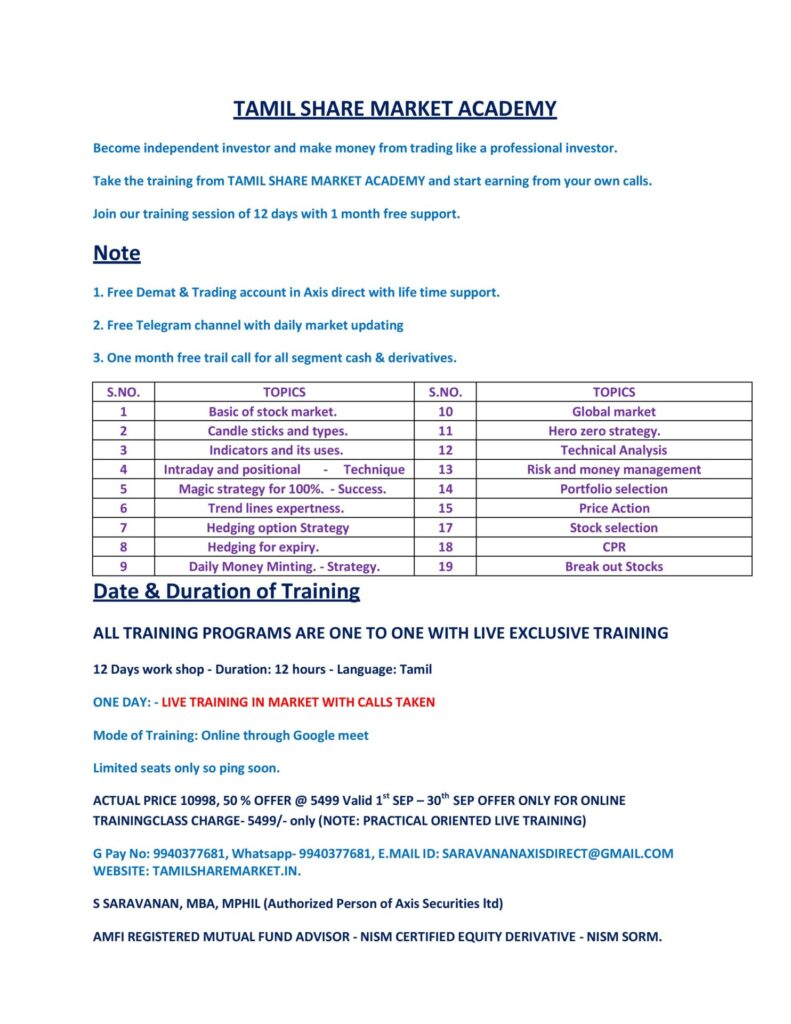

Share Market Training

Unlock the secrets of successful investing with our comprehensive share market training

NISM Certificate Course

Explore specialized knowledge in securities markets, mutual funds, derivatives, and more.

Mutual Fund

Tailored to your goals and risk tolerance, they open the doors of financial market potential, even for beginners.

Insurance

Safeguard what matters most with a safety net that ensures peace of mind and financial security for you.

Bonds

Bonds provide consistent interest payments and a range of risk options, granting stability in your investment voyage.

Endowment Plan

create a financial safety net while allowing you to savor precious moments.

Benefits

- You will get the knowledge and skills necessary to build a profitable and robust trading plan

- You will know about all different assets and how they correlate.

- You will learn how to enhance your performance and build a strong foundation on how to plan and execute the trade.

- You will learn to think like a professional while gaining an in-depth understanding of different trading techniques

- You will learn about the various advanced technical tools and techniques like charts, candlesticks & bars, support and resistance, trend lines, pivot points, and oscillators.

- You will learn the technical patterns and how to use them for profitable trading setups.

- You will know how to implement trading strategies using important technical tools and indicators in the stock market.

- You will learn how to maximize profit and use techniques to minimize risk for smart trading.

Training

Lifetime Support

If you have any doubt, you can directly contact to Mr.Saravanan (Trainer) MBA.,M.Phil to clarify all your trading related doubts.

Our Courses

An entry-level course for those new to trading and investment, covering essential concepts and terminology.

Delve deep into the world of technical analysis,learning to read charts and identify patterns.

Explore various trading styles and develop strategies that align with your risk tolerance and goals.

Our Core Values

Our team consists of industry experts who bring a wealth of practical experience to the classroom. We believe in imparting knowledge that is not only accurate but also relevant in real-world trading scenarios.

Our mission is to empower individuals with the tools and strategies needed to navigate the share market confidently. We believe that financial education is the key to making informed decisions and achieving financial freedom.

Trust is the cornerstone of our academy. We uphold the highest standards of integrity in our teachings, ensuring that our learners receive accurate information and unbiased guidance.

The financial markets are ever-evolving. We embrace a culture of continuous learning, both for ourselves and our students. Our courses are regularly updated to reflect the latest market trends and insights.

Stock Market Course Content

- What is the Stock Market?

- Types of Financial Markets

Stock Exchanges and Market Particip

Understanding Stocks, Bonds, and Securities

Basics of Investment and Risk

- Financial Statements: Balance Sheet, Income Statement, Cash Flow Statement

Ratios: Price-to-Earnings (P/E), Earnings Per Share (EPS), Debt-to-Equity, etc.

Evaluating Company Health and Performance

Analyzing Dividends and Dividend Yield

Assessing Company Management and Strategy

- Basics of Technical Analysis

Chart Patterns: Head and Shoulders, Double Tops and Bottoms, etc

Indicators: Moving Averages, Relative Strength Index (RSI), MACD, etc.

Trendlines, Support, and Resistance

Candlestick Patterns and Interpretation

- Types of Trading: Day Trading, Swing Trading, Position Trading

Momentum Trading Strategies

Value Investing Strategies

Growth Investing Strategies

Developing a Trading Plan

- Understanding Risk and Reward

- Setting Stop-Loss and Take-Profit Orders

Emotional Discipline and Trading Psychology

Managing FOMO (Fear of Missing Out) and FEAR (Fear, Ego, Avarice, Regret)

Psychological Biases in Trading

- Economic Indicators: GDP, Inflation, Unemployment, etc

Market News and Its Impact

Global Events and Market Movement

Interpreting Central Bank Decisions

- Introduction to Trading Platforms

Placing Orders: Market Orders, Limit Orders, Stop Orders

Using Technical Analysis Tools

Paper Trading and Virtual Portfolios

- Analyzing Real Trading Scenarios

Developing and Testing Trading Strategies

Simulated Trading Exercises

Learning from Mistakes and Successes

- Securities Laws and Regulations

Insider Trading and Ethical Considerations

Trading Restrictions and Compliance

- Understanding Portfolio Allocation

Asset Allocation: Stocks, Bonds, Real Estate, etc.

The Role of Mutual Funds and Exchange-Traded Funds (ETFs).

Why Choose Us

- 1000+ Satisfied Students

- Basic to Advanced Level Courses

- Price Action

- CPR (Advanced levels)

- Online & Offline Classes

- NISM (NSE) Certified Courses.